The potential for AI to revolutionize industries and improve lives has been widely acknowledged, but economists are predicting that the impact of AI poses a pressing concern for the global economy.

At the AI for Good Global Summit 2024, Gita Gopinath, First Deputy Managing Director of the International Monetary Fund (IMF), shed light on the economic risks AI poses and outlined several strategies to mitigate them.

The Dual-Edged Nature of AI

Gopinath began by highlighting AI’s dual-edged nature.

“Generative AI can help humanity. It can help us live better lives [and] accelerate scientific breakthroughs,” she said, emphasizing the positive potential of AI to enhance global productivity.

The promise of AI to raise global productivity is particularly significant given the current economic climate. “Right now, we are facing one of the weakest growth projections in the medium term for the world economy, so anything that can help raise productivity would be exceptionally valuable,” Gopinath noted.

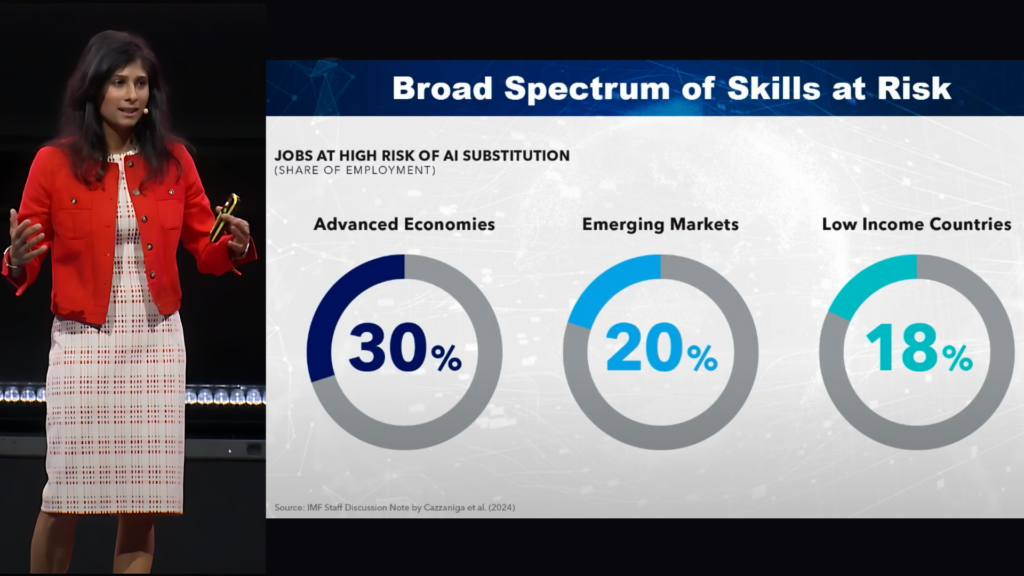

She noted that many current studies are focused on the particular jobs at high risk of AI substitution.

While it is important to look at the at the broad range of skills at risk in a highly automated global economy, she also brings attention to the less-discussed economic risks, noting that AI could “amplify the next economic downturn.”

The widespread adoption of AI, while beneficial in many respects, also carries the potential to deepen and prolong economic crises by disrupting labor markets, financial markets, and supply chains.

She discusses these key risks and some of the policy and economic solutions that can be taken in the short-term to mitigate these risks.

Watch the full session here

Labor Market Disruptions

One significant risk involves the labor market. Historical patterns of automation show that firms invest in technology during prosperous times but resort to automation to cut costs during recessions, leading to job losses. Gopinath illustrated this with a striking statistic: “Close to 90% of automation-related job losses happen in the first year of a recession.” This pattern was evident during the Great Financial Crisis of 2008-09, where the increase in automation led to one of the most severe jobless recoveries on record.

Gopinath argued that AI’s impact extends beyond routine jobs, threatening a broader spectrum of skills, including high-skilled cognitive roles. She warned, “Our research shows that in advanced economies, about 30% of jobs are at high risk of displacement; in emerging markets, that number is 20%; and in low-income countries, it is 18%.” The risk of long-term unemployment resulting from AI-driven job displacement is significant and could have severe economic consequences.

Financial Market Dynamics

“AI has the ability to use a vast amount of information to make predictions you could end up with greater market efficiency [ending] up with greater financial inclusion, and that’s wonderful,” Gopinath explained.

However, the financial sector is also vulnerable to the disruptive potential of AI. While AI promises increased efficiency and financial inclusion, its application in finance could have unintended consequences during economic instability. She explained, “These newer models have been shown to perform poorly in the face of novel events […] that are very different from the kinds of data they have been trained on, and one thing we know is that no two recessions tend to be the same.” Unlike traditional models, these advanced AI systems might struggle with unexpected economic conditions, leading to detrimental outcomes.

A key risk is the potential for AI-driven investment strategies to exacerbate market volatility. “You could very well have a scenario where you see a very quick simultaneous move in portfolio allocation of assets to safe assets away from risky assets,” Gopinath described. Such moves could trigger “fire sales and herding behavior,” leading to larger collapses in asset prices. Given the black-box nature of many AI applications, controlling such events could prove challenging.

Supply Chain Vulnerabilities

Supply chains, another critical component of the global economy, could face severe disruptions due to AI. Generative AI used for inventory and production predictions might fail under unprecedented conditions, resulting in “serious forecast errors and cascading breakdowns in supply chains.” The recent COVID-19 crisis demonstrated how costly such disruptions can be, affecting prices and the cost of living.

Gopinath pointed out that during normal times, AI’s predictive capabilities can enhance efficiency and productivity. However, in a future downturn, AI models trained on outdated data could exacerbate supply chain issues. This could lead to significant economic disruptions, reminiscent of the high pressure on supply chains witnessed during the COVID-19 pandemic.

Mitigation Policies

To prevent AI from exacerbating economic downturns, Gopinath proposed several policy measures. These policies aim to balance the benefits and risks of AI, ensuring it serves as a tool for progress rather than a crisis amplifier.

- Balanced Tax Systems

First, Gopinath called for a balanced tax system: “Governments around the world give multiple forms of incentives to companies in terms of what to invest in,” she noted. Currently, many tax systems inefficiently favor automation over human employment. This imbalance could encourage firms to prioritize AI investments that replace human jobs, especially during downturns. Policymakers must reconsider these incentives to avoid exacerbating job displacement during economic crises.

- Helping Workers Cope with the Impact of AI

Investment in education and upskilling is crucial to help workers adapt to AI-driven changes. Gopinath emphasized the need for “greater investments in education and skilling to match what they can do with AI,” particularly in emerging markets and developing countries. Indeed, according to a recent study by IMF, “emerging markets and middle- income and low-income countries are less prepared to deal with the AI transition.” By equipping workers with the skills needed to work alongside AI, economies can better withstand the disruptive impacts of technological advancements.

Moreover, these measures to support workers need to come along with a strengthening of social safety nets in environments where there are more job losses, Gopinath argued. Robust safety nets can provide temporary relief to displaced workers and facilitate their transition to new employment opportunities, reducing the long-term economic impact of job losses.

“There are ways to strengthen these safety nets, including through more generous provision of unemployment insurance […]. [By doing that], you give workers a longer time to look for a better match, and then the automation-related wage declines that they typically see [can be] overcome”, she explained.

- Enhanced Financial Regulation and Supervision

Lastly, Gopinath stressed the importance of enhancing financial regulation and supervision to manage the risks associated with AI in financial markets. Regulators must become familiar with new technologies to effectively oversee their application. “Improving forms of supervision and regulation” is essential to mitigate the risks of AI-driven financial instability. Enhanced disclosures by financial institutions can also help in monitoring and managing the risks posed by advanced AI models.

While AI holds immense promise for enhancing productivity and improving lives, its potential to deepen economic downturns cannot be ignored. Gopinath’s insights at the AI for Good Global Summit underscore the need for a balanced approach to AI adoption.

“AI has the power to change our lives and the global economy, and we have the power to shape that change for the better,” Gopinath concluded.

By implementing thoughtful policy measures, such as balanced tax systems, investment in education and upskilling, strengthened social safety nets, and enhanced financial regulation, policymakers can ensure that AI serves as a force for progress rather than a crisis amplifier. The goal is to harness the transformative potential of AI while mitigating its risks, shaping a future where technology enhances economic resilience and prosperity.